Want to be in the loop?

subscribe to

our notification

Business News

REAL ESTATE BONDS PLACE PRESSURE ON ISSUING FIRMS

Nearly 36% of bonds issued by real estate firms are approaching maturity and thus piling greater pressure on issuers at this critical juncture, the Ministry of Finance said on April 22.

The ministry’s recent report underscores concerns within Vietnam’s corporate bond market for 2023 and 2024. It emphasizes the critical need to address hindrances to the real estate sector in line with the objectives provided in Government Resolution No. 33/NQ-CP, which aims to stabilize the industry.

Although a reduction in bond maturities is anticipated for 2024 compared to 2023, those sectors susceptible to payment difficulties such as real estate and renewable energy will have to cope with the heavy burden of bond redemption. Around VND35.8 trillion, representing nearly 36% of real estate bonds, are expected to encounter payment challenges.

By the end of 2023, the outstanding corporate bond debt of 432 issuers had amounted to VND1 quadrillion. The total value of bonds that will fall due this year is VND240 trillion, a decline from the VND261.6 trillion maturity volume in 2023.

Banks are perceived as low-risk borrowers due to stringent capital adequacy requirements mandated by regulators and close supervision by the State Bank of Vietnam, ensuring their financial stability. The majority of bondholders are institutional investors.

Vietnam’s real estate sector is a major borrower in the country’s bond market, representing a substantial 35% of all outstanding bonds. The sector carries a debt burden of VND351.4 trillion, divided between secured (VND285.2 trillion) and unsecured (VND66.2 trillion) bonds, with institutional investors holding the majority (58.6%) compared to individuals (41.4%).

Source: The Saigon Times

Related News

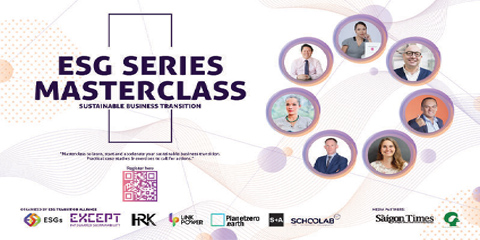

ESG SERIES MASTERCLASS

Join the ESG Series Masterclass today and be a part of the solution led by our team of industry experts Bao Nguyen, Betty Pallard, Chi Nguyen, Jonathan SOURINTHA - HRK Group - PVA PRO - GPS (iBAG), Markus Klemmer, Paula Fajardo, Sergio Pereira da Silva along with many more to come…

VIETNAM’S GDP TO GROW 5.5% THIS YEAR – WB

This forecast is based on the assumption of a moderate recovery in manufacturing exports in 2024, fueled by rebound growth of 8.5% year-on-year in the fourth quarter of 2023 and 17.2% year-on-year in the first quarter of 2024, reflecting strengthening global demand, said Dorsati Madani, senior country economist at the WB in Vietnam.

FARE REFUND FOR VISA REJECTION

Cathay Pacific will offer full refunds for cases of visa rejection to provide you with the confidence to explore the world with ease. If you are planning to fly to a destination that requires an entry visa, you can now book with greater peace of mind.

FOUR COMMODITIES POST Q1 EXPORT VALUE OF OVER 5 BILLION USD

The total export turnover of agricultural, forestry, and fisheries products in the first three months of 2024 is estimated to reach 13.53 billion USD, an increase of 21.8% compared to the same period of 2023.

MOIT PROPOSES SCHEME TO BOOST RENEWABLE ENERGY PROCUREMENT

The proposed Direct Power Purchase Agreement (DDPA) mechanism, outlined in the draft decree, targets organisations and individuals consuming electricity from the 22kV power grid or higher, with a monthly consumption averaging 500,000kWh. However, residential households are excluded from direct procurement.

DA NANG CUSTOMS FOCUSES ON DEVELOPING CUSTOMS-BUSINESS PARTNERSHIPS

Da Nang Customs Department issued an action plan for developing customs-business partnership in 2024. One of the new events this year is the workshop on “Settlement reports for enterprises engaged in outsourcing, export production and export processing” held in Da Nang Customs Department on April 16, 2024.