Want to be in the loop?

subscribe to

our notification

Business News

POSITIVE OUTLOOK FOR VIỆT NAM’S BANKING SECTOR IN 2025

Bank stocks will deliver a strong performance again this year, partly because sector-wide bank earnings growth is expected to accelerate from 14 per cent in 2024 to 17 per cent in 2025 driven by a shift in GDP growth drivers from external factors to domestic driven growth, according to investment management firm VinaCapital.

Banking sector’s earnings growth is expected to pick up this year driven by a shift in GDP growth drivers from exports and tourism in 2024 to consumption, infrastructure spending, and real estate in 2025. — Photo courtesy of HDBank

HCM CITY — Bank stocks will deliver a strong performance again this year, partly because sector-wide bank earnings growth is expected to accelerate from 14 per cent in 2024 to 17 per cent in 2025 driven by a shift in GDP growth drivers from external factors to domestic driven growth, according to investment management firm VinaCapital.

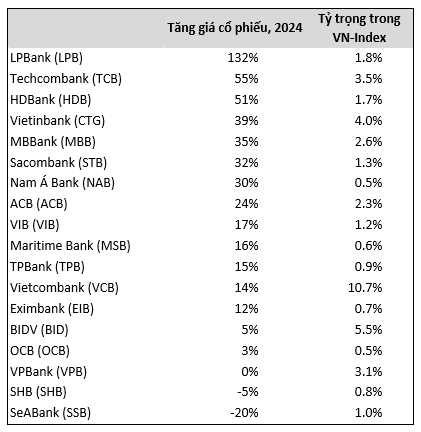

Bank stocks significantly outperformed the VN-Index in 2024 with the 18 banks listed on the Ho Chi Minh Stock Exchange surging 26 per cent in VND terms versus 12 per cent for the VN-Index.

A recent report conducted by Michael Kokalari, chief economist at VinaCapital, and Nguyễn Thị Thúy Anh, senior bank analyst at VinaCapital, pointed out that earnings growth acceleration, coupled with attractive valuations (1.3x price to book (P/B) versus 16 per cent return on equity (ROE)), should drive further stock price appreciation.

According to the report, Việt Nam’s export growth to the US is projected to plunge this year, which should be offset by increases in infrastructure spending, real estate development activity, and consumer spending.

Slower export growth will weigh on GDP growth because exports are nearly 100 per cent/GDP, but most of Việt Nam’s exports are produced by FDI companies that are not reliant on local banks for financing; while slower exports will affect the economy, they will not significantly hurt the banks.

Furthermore, banks should be the biggest beneficiaries of the shift to more domestically driven growth because Vietnamese banks touch nearly every part of the country’s domestic economy, and banks are especially exposed to real estate and consumption, which will help drive the economy in 2025.

VinaCapital expected that the Government will take concrete steps to boost the real estate market this year, which could result in mortgage loan growth doubling from around 10 per cent in 2024 to 20 per cent in 2025.

A real estate market revival would also boost consumer confidence, as well as other forms of high margin consumer lending, such as auto loans and buy-now-pay-later purchases.

The Government also plans to support 2025 GDP growth by spending more on infrastructure development, which should create more lending opportunities for banks.

They stressed that the combination of increased infrastructure spending, improved consumer sentiment, and a real estate market revival would all propel banks’ credit growth, support banks’ net interest margins (NIMs), and foster the ongoing recovery of asset quality in Việt Nam.

Recovering asset quality and improving loan mix

The 18 banks listed on the Ho Chi Minh Stock Exchange surged 26 per cent in VND terms versus 12 per cent for the VN-Index in 2024. Bank stocks are expected to deliver a strong performance again this year. — Source VinaCapital

The two experts expected the earnings of Việt Nam’s listed banks to grow 17 per cent this year, driven by 15 per cent system-wide credit growth and by a slight increase in system-wide NIM (by 6 basis points (bps) to 355 bps in 2025). The ongoing recovery in asset quality will also support earnings growth somewhat this year, as will an improved composition of loan growth.

Việt Nam’s system-wide loan growth is expected to remain at around 15 per cent in 2025 but for high-margin retail loan growth to accelerate from around 12 per cent in 2024 to 15 per cent in 2025.

They also expected banks to make more long-dated loans this year by lending to infrastructure projects, which typically have long time horizons. The resulting “maturity transformation” associated with those new long-dated loans will support NIMs (banks earn higher profits by gathering short-term deposits and extending long-term loans that usually earn higher interest rates).

Finally, real estate lending picked up considerably last year as the market recovery gathered steam, although some lending to real estate developers was for the refinancing of maturing corporate bonds that developers previously sold to retail and other investors.

Attractive valuations

Kokalari underscored that Vietnamese bank stocks are trading at a 1.3x price to book for 2025 versus 16 per cent expected return on equity, which is nearly two standard deviations below banks’ 5-year average P/B (banks that generate 16 per cent ROE typically trade above 2x P/B).

Valuation is also cheap on a Price Earnings Ratio basis at 0.5x PEG (8x FY2025 P/E vs. 17 per cent EPS growth). Last year, valuations were even cheaper before a partial re-rating of bank stock valuations, when the increase in bank stock prices (26 per cent) outpaced EPS growth (14 per cent).

One reason for that cheap valuation is that Việt Nam’s 30 per cent foreign ownership limit for banks essentially makes local retail investors the marginal buyers who set bank stock prices in Việt Nam, and those investors are not as focused on valuations as foreigners.

Investors in Việt Nam’s stock market are generally aware of the sector’s inexpensive valuation, but many do not realise how big the divergence is between the valuations and stock price performance of individual banks, or how much divergence there is between the operating, asset quality, and other metrics among individual banks, he said. — VNS

Source: VNS

Related News

VIETNAM’S AGRO-FORESTRY-FISHERY EXPORTS JUMP NEARLY 30% IN JANUARY

Vietnam’s exports of agricultural, forestry and fishery products surged nearly 30% year-on-year in January 2026, driven by strong growth across major commodity groups and key export markets, according to the Ministry of Agriculture and Environment. Export turnover for the sector in January is estimated at nearly US$6.51 billion, up 29.5% from the same period last year, the ministry said at a regular press briefing on February 5.

INFOGRAPHIC SOCIAL-ECONOMIC PERFORMANCE IN JANUARY OF 2026

The monthly statistical data presents current economic and social statistics on a variety of subjects illustrating crucial economic trends and developments, including production of agriculture, forestry and fishery, business registration situation, investment, government revenues and expenditures, trade, prices, transport and tourism and so on.

PHUC VUONG DISTRIBUTES "TET REUNION" GIFTS: SENDING LOVE TO THE CONSTRUCTION SITES

On the afternoon of February 6th, amid the busy year-end atmosphere, Phuc Vuong Company organized the "Tet Reunion – Spring Connection" gift-giving event right at the construction site. This annual activity aims to honor the "dream builders" who have dedicated themselves to the company's growth. The General Director was present to personally express his sincere gratitude and hand over meaningful Tet gifts to the workers.

INTERNATIONAL ARRIVALS TO VIETNAM REACH NEW MONTHLY HIGH

International arrivals to Vietnam hit a new monthly record in January 2026, rising 21.4% from the previous month and 18.5% year-on-year, according to the National Statistics Office. Air travel continued to dominate, accounting for nearly 80% of all arrivals. Arrivals by land nearly doubled compared with the same period last year, while sea arrivals rose by about 30%, though they remained a small share.

HCMC APPROVES 28 MORE LAND PLOTS FOR HOUSING DEVELOPMENTS

HCMC has approved 28 out of 30 proposed land plots for pilot housing developments, covering a combined area of more than 750,600 square meters, according to a newly adopted resolution. The approved sites are spread across multiple wards and communes, with a strong concentration in the city’s southern and eastern areas.

VIETNAM SEES STEADY FDI DISBURSEMENT BUT SLOWER EXPANSION IN JANUARY

Foreign direct investment (FDI) disbursement in Vietnam rose in January, while newly registered capital fell sharply, pointing to stable project implementation but slower investment expansion. Data from the Ministry of Finance showed that January FDI disbursement increased 11.26% year-on-year to US$1.68 billion, reflecting continued execution and expansion of existing foreign-invested projects.