Want to be in the loop?

subscribe to

our notification

Business News

TRANSPORT SECTOR SHOWS STRONG DIVERGENCE IN H1 PERFORMANCE

While leading companies are reporting robust growth, others, particularly those with ageing fleets, are facing declining profits.

A container ship managed and operated by Hai An Transport & Stevedoring. — Photo haiants.vn

HÀ NỘI — The Vietnamese transport sector has witnessed significant divergence in performance during the first half of 2025, with leading companies reporting robust growth while others, particularly those with ageing fleets, facing declining profits.

This trend reflects the broader dynamics of Việt Nam's trade landscape, which has seen a substantial increase in export and import activity.

According to the General Statistics Office, Việt Nam’s total export-import turnover reached US$432 billion in the first half of 2025, marking a 16.1 per cent increase from the same period last year. Key export commodities, including textiles, footwear, computers and electronic components, maintained double-digit growth, driven by rising demand and a strategy of front-loading to mitigate the impacts of changing tariffs.

In the medium to long term, companies are diversifying their export markets and increasing local content to leverage signed trade agreements, thereby expanding their consumer base and reducing the impact of US tariffs.

As a direct consequence of the shifts in trade flows, the transport sector has experienced a notable difference in performance.

For instance, Hai An Transport & Stevedoring JSC reported a remarkable revenue increase of 47.9 per cent to VNĐ2.44 trillion ($93 million) in the first half of 2025, with profit after tax soaring by 291.3 per cent to VNĐ688 billion. This result meant the company achieved 79.5 per cent of its annual profit target in just six months.

In February, Hai An successfully acquired another container ship, Haian Zeta, with a capacity of 1,702 TEU, increasing its fleet to 17 vessels primarily focused on intra-Asian routes.

However, Haian Zeta has been chartered to partner Sealead Shipping for operations on the route from the Mediterranean and North Africa to the east coast of the US. This marks Hai An's first foray into the US market, paving the way for future investments in long-haul routes to destinations like the US and Europe.

Previously, Hai An has also been proactive in modernising its fleet, adding vessels including Haian Link and Haian Bell (2018), Haian Mind (2019), Haian East and Haian West (2021), as well as Anbien Bay, Haian City and A Roku (2022).

In 2024, the company expanded its operations further by taking delivery of four new container ships.

In contrast, the PetroVietnam Transportation Corporation (PVTrans) saw its revenue rise by 29.3 per cent to VNĐ7.14 trillion, but its profit after tax fell by 6.1 per cent to VNĐ638 billion, completing only 66.4 per cent of its annual profit target.

Meanwhile, Vietnam Ocean Shipping JSC (Vosco) and Vinaship reported significant downturns.

Vosco’s profit before tax plummeted to a loss of VNĐ43.7 billion, while Vinaship's profit dropped dramatically by 98.7 per cent to just VNĐ440 million.

Until recently, neither company had made new investments for over a decade.

Vinaship invested in the Vinaship Unity vessel at the end of 2024, while Vosco announced plans to invest in 10 new vessels, with a total potential value of $414 million. However, their ageing fleets may hinder their operational efficiency compared to newer ships.

Given their performance, stock prices for Vosco and Vinaship have remained stagnant over the past seven months.

Hai An’s stock experienced a surge in May following tariff delays, but has since levelled off, showing only a slight decline of 1.2 per cent from late May to mid-August.

Looking ahead, Shinhan Securities Vietnam predicts that new tariffs imposed by the US are unlikely to trigger a surge in shipping volumes in the latter half of the year.

With average spot freight rates on major routes from the Far East to the US dropping significantly, the industry may face overcapacity challenges.

The long-term application of high tariffs on imported goods, particularly from China, could lead to shifts in maritime trade flows.

Analysts expect increased activity on intra-Asian and Asia-Europe routes as domestic companies adapt to mitigate the impacts of the US market. — BIZHUB/VNS

Source: VNS

Related News

PRACTICAL CONSTRUCTION WORK

At Phuc Vuong, we do not focus on talking about our capabilities. Instead, every project currently under construction serves as the clearest and most direct proof. From site preparation, piling works, and foundation construction to structural works and major items, our technical team remains closely involved on site, monitoring every detail.

INTERNATIONAL ARRIVALS TO PHU QUOC AT RECORD HIGH

On January 17, Phu Quoc International Airport handled 47 international flights in a single day, the highest level since the airport began operations. Earlier, on January 3, the airport had already set a new record with 46 international flights in one day. Notably, the surge was not confined to a few peak days. International arrivals were maintained at a high level throughout January, pointing to a more sustained and stable expansion of the international travel market to the island.

VIETNAM PUTS SCIENCE, TECHNOLOGY AT CENTER OF 2026 GROWTH STRATEGY

Vietnam will make science and technology, innovation and digital transformation the core drivers of economic growth in 2026, under a Government resolution guiding this year’s socio-economic development and budget implementation. The direction is set out in Resolution No. 01 on key tasks and solutions for 2026, reported the Government news website (baochinhphu.vn).

VIETNAM ECONOMIC NEWS INSIGHT & RECAP - DECEMBER 2025

Vietnam closed 2025 with an impressive economic performance, exceeding initial targets and demonstrating the resilience of its growth model. Full-year GDP expanded by 8.02% supported by a combination of government-led stimulus, stable domestic production and consumption, and continued strength in key export sectors amid ongoing external uncertainties.

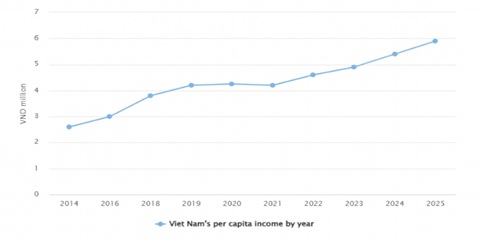

PER CAPITA INCOME CLIMBS 9.3% IN 2025

Average per capita income in 2025 was estimated at VND5.9 million (approximately US$225) per month, marking a 9.3 percent increase from 2024, according to preliminary findings of the Household Living Standards Survey 2025 conducted by the National Statistics Office (NSO). Part of the income growth stemmed from State payments to public officials and employees who retired or resigned under the restructuring of the political system's organizational apparatus.

INDUSTRY AND TRADE SECTOR MAINTAINING GROWTH MOMENTUM, FORGING SUSTAINABLE DEVELOPMENT

In 2025, Hai Phong City benefited from significant opportunities created by an expanded development space following administrative consolidation, while also facing challenges in maintaining stable and efficient administrative operations and sustaining strong economic growth amid ongoing global volatility. Within this context, the industry and trade sector continued to serve as an important driving force for the city’s overall economic growth.