Want to be in the loop?

subscribe to

our notification

Business News

VIETNAM’S INFRASTRUCTURE EXPANSION ACCELERATES ON BOND MARKET INNOVATION

Vietnam’s infrastructure ambitions, which are estimated to cost $245 billion through 2030, depend on unlocking long-term private capital.

Photo: Istock

According to a report by VIS Rating and Credit Guarantee & Investment Facility (CGIF) on July 24, with public funding falling short and bank lending constrained, Vietnam’s infrastructure ambitions hinge on mobilising private capital through the corporate bond market. Between 2025 and 2030, the country will need an estimated $245 billion for expressways, high-speed rail, and power projects, yet public funding can only cover 70 per cent. Private investment has already become a key driver, accounting for over half of registered fixed asset investment.

As bank lending tightens, due to regulatory limits on using short-term deposits for long-term loans, the role of the bond market becomes even more critical. Bank credit to toll road projects, for instance, has declined by 6 per cent annually since 2020. To close the infrastructure financing gap, Vietnam must deepen its corporate bond market and attract long-term private capital.

Indeed, Vietnam’s bond market is gaining traction as a key channel for infrastructure financing. Recent regulatory reforms are paving the way for companies to issue bonds more flexibly, such as through private placements without historical financials under the amended Public-Private Partnership Law. The state is also stepping in with higher equity contributions to ease debt burdens and improve credit quality.

A forthcoming decree is expected to further unlock the market by allowing public offerings and immediate listings of infrastructure bonds. While issuance conditions will be eased, post-issuance controls, such as trustee oversight, escrow accounts, and regulated disbursements, will tighten, creating a more robust legal framework.

Meanwhile, new requirements on disclosure, issuance standards, and mandatory credit ratings are boosting transparency and investor confidence. Together, these reforms position corporate bonds as a more viable, long-term funding tool for Vietnam’s infrastructure ambitions.

The report also indicates that credit guarantees and credit ratings are crucial tools for unlocking private capital for infrastructure development. Infrastructure projects often carry weaker credit profiles due to high leverage, single revenue streams, and exposure to construction risks. Limited track records and restricted access to project agreements further complicate investor assessments. Long tenors, often 15 to 20 years, also heighten liquidity risk.

Credit guarantees provide support to project bond issuers, thereby enhancing credit quality and reducing bondholders’ exposure to project-related risks. CGIF’s regional portfolio, including several infrastructure projects in Vietnam, demonstrates how credit guarantees can support project owners in broadening their investor base and facilitating access to capital markets.

Recent regulatory reforms, along with stronger disclosure, credit ratings, and guarantees, are laying the groundwork for deeper investor participation.

Source: VIR

Related News

PRACTICAL CONSTRUCTION WORK

At Phuc Vuong, we do not focus on talking about our capabilities. Instead, every project currently under construction serves as the clearest and most direct proof. From site preparation, piling works, and foundation construction to structural works and major items, our technical team remains closely involved on site, monitoring every detail.

INTERNATIONAL ARRIVALS TO PHU QUOC AT RECORD HIGH

On January 17, Phu Quoc International Airport handled 47 international flights in a single day, the highest level since the airport began operations. Earlier, on January 3, the airport had already set a new record with 46 international flights in one day. Notably, the surge was not confined to a few peak days. International arrivals were maintained at a high level throughout January, pointing to a more sustained and stable expansion of the international travel market to the island.

VIETNAM PUTS SCIENCE, TECHNOLOGY AT CENTER OF 2026 GROWTH STRATEGY

Vietnam will make science and technology, innovation and digital transformation the core drivers of economic growth in 2026, under a Government resolution guiding this year’s socio-economic development and budget implementation. The direction is set out in Resolution No. 01 on key tasks and solutions for 2026, reported the Government news website (baochinhphu.vn).

VIETNAM ECONOMIC NEWS INSIGHT & RECAP - DECEMBER 2025

Vietnam closed 2025 with an impressive economic performance, exceeding initial targets and demonstrating the resilience of its growth model. Full-year GDP expanded by 8.02% supported by a combination of government-led stimulus, stable domestic production and consumption, and continued strength in key export sectors amid ongoing external uncertainties.

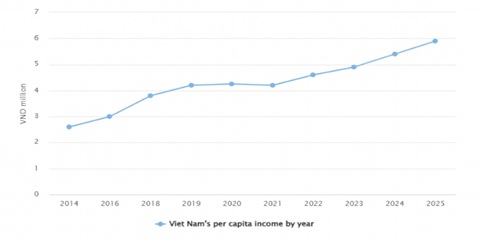

PER CAPITA INCOME CLIMBS 9.3% IN 2025

Average per capita income in 2025 was estimated at VND5.9 million (approximately US$225) per month, marking a 9.3 percent increase from 2024, according to preliminary findings of the Household Living Standards Survey 2025 conducted by the National Statistics Office (NSO). Part of the income growth stemmed from State payments to public officials and employees who retired or resigned under the restructuring of the political system's organizational apparatus.

INDUSTRY AND TRADE SECTOR MAINTAINING GROWTH MOMENTUM, FORGING SUSTAINABLE DEVELOPMENT

In 2025, Hai Phong City benefited from significant opportunities created by an expanded development space following administrative consolidation, while also facing challenges in maintaining stable and efficient administrative operations and sustaining strong economic growth amid ongoing global volatility. Within this context, the industry and trade sector continued to serve as an important driving force for the city’s overall economic growth.