Want to be in the loop?

subscribe to

our notification

Business News

CONSUMER DEALS DRIVE VIETNAM’S M&A REBOUND IN DECEMBER

Vietnam’s merger and acquisition (M&A) market showed renewed momentum at the end of the year, supported by increased deal activity and a rebound in transaction values.

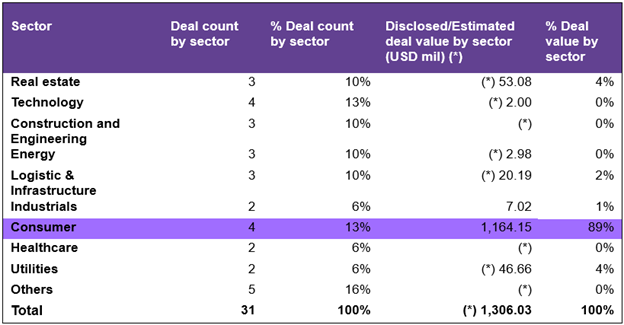

Vietnam recorded 31 M&A deals in December, with total disclosed and estimated transaction value reaching approximately $1.3 billion, according to Grant Thornton. The firm’s December report showed the consumer sector led the market during the month, ranking first in both deal volume and value, driven largely by transactions aligned with long-term strategic expansion.

Notable transactions during the month included Kokuyo’s acquisition of Thien Long, with an estimated value of about $185 million, and Thailand-based Fraser and Neave’s additional share purchase in Vinamilk, valued at around $228 million. Grant Thornton noted that these deals reflected an M&A trend increasingly driven by strategic expansion rather than short-term financial investment.

In addition, a number of large-scale transactions were executed with a primary focus on corporate restructuring, most notably the transfer of the MM Mega Market Vietnam retail chain among entities within Thailand’s diversified private conglomerate, TTC group, with an estimated value of approximately $715 million.

Meanwhile, foreign investors continued to act as the principal catalyst for market activity, with particularly prominent participation from Japanese and Thai investors in the transactions recorded during the period.

Several high-profile M&A transactions stood out during the period. In early December, Kokuyo Corporation (Japan) announced the acquisition of a total 65.01 per cent equity stake in Thien Long Group for an estimated transaction value of $185 million.

The acquisition is structured to be implemented in two phases. In the first phase, Kokuyo will acquire the entire equity stake held by Thien Long An Thinh Investment JSC, which currently owns around 47 per cent of TLG.

In the second phase, Kokuyo will conduct a public tender offer to acquire an additional 18.2 per cent of TLG shares from other shareholders.

Kokuyo has been present in the Vietnamese market for many years through its well-known stationery products, including notebooks, various pen lines, markers, gel pens, and Campus-branded educational and office supplies. The acquisition of a controlling stake in Thien Long Group is expected to create strong momentum for the Japanese conglomerate to rapidly expand and secure a significant market share in Vietnam.

In the hot real estate sector, Ngan Hiep Real Estate JSC has announced the completion of its acquisition of more than 30 million shares of SEA in Vietnam National Seaproducts Corporation (Seaprodex).

Prior to the transaction, Ngan Hiep held no shares in SEA, following the deal, the company has become a major shareholder with a 24.03 per cent ownership stake. On the same day, Redwood Investment JSC purchased more than 10.5 million SEA shares, increasing its ownership from zero to 8.44 per cent.

The total transaction value is estimated at $53 million. Ngan Hiep is a subsidiary of Novaland Group, which holds a 99.98 per cent equity stake. The company is currently the developer of the NovaWorld Ho Tram project, including the Wonderland and Habana Island phases.

However, SSG Group divested its entire holding of more almost 15 million SEA shares (equivalent to just under 12 per cent of Seaprodex’s charter capital) on December 23. As a result, SSG ceased to be a major shareholder of Seaprodex after just four months of ownership.

In construction and engineering, Daikin Industries Limited, the world’s leading air-conditioning equipment manufacturer based in Japan, through its subsidiary Daikin Air Conditioning (Vietnam) JSC, signed an agreement to acquire Anh Nguyen Engineering Trading and Services JSC, a Ho Chi Minh City, based firm specialising in the design, supply, and installation of Building Management Systems (BMS) and integrated engineering solutions for industrial and hospitality projects.

The transaction aims to strengthen Daikin’s capabilities in delivering fully integrated solutions that combine heating, ventilation, and air-conditioning (HVAC) systems with smart building control technologies. This move is intended to address the growing demand for energy efficiency amid Vietnam’s rapid economic growth and the country’s commitment to achieving carbon neutrality by 2050. The transaction value has not been disclosed.

In logistics and infrastructure, Duc Long Gia Lai Group has approved a plan to divest its almost 71 per cent equity stake in the Duc Long Dak Nong build-operate-transfer scheme and BT JSC to Alpha Seven Group. The transaction is valued at around $20 million.

In the utilities sector, the board of directors of Vietnam Construction and Import-Export JSC approved the acquisition of a more than 98 per cent equity stake in Vietnam Water and Environment Investment Corporation JSC on December 4 through a public auction organised by the State Capital Investment Corporation. The transaction value is estimated at $47.3 million.

Meanwhile in healthcare, DKSH Group of Switzerland signed an agreement to acquire Biomedic Science Material JSC, a Hanoi-based distributor of diagnostic and screening equipment and consumables serving the fields of oncology, obstetrics and gynaecology, infectious diseases, and forensic medicine in Vietnam.

Founded in 2008, Biomedic employs more than 80 staff across three locations nationwide and generates annual revenue of nearly $15.25 million with strong profitability. The company serves a broad customer base including hospitals, diagnostic laboratories, and fertility clinics, with the majority of revenue derived from a recurring model that combines equipment supply with regular consumables. The transaction value has not been disclosed.

In entertainment, Sony Music Entertainment Hong Kong Limited, a member of Sony Music Entertainment, has entered into a strategic investment agreement with YeaH1 Group JSC to acquire an equity interest in 1Label JSC, the music production and distribution platform within the YeaH1 ecosystem.

Under the terms of the agreement, Sony Music is expected to hold a 49 per cent stake with voting rights in 1Label.

Upon completion of the transaction, both 1Label and 1Talents JSC (the group’s artist management) will be reclassified from subsidiaries to associates of YeaH1.

Source: VIR

Related News

VIETNAM’S AGRO-FORESTRY-FISHERY EXPORTS JUMP NEARLY 30% IN JANUARY

Vietnam’s exports of agricultural, forestry and fishery products surged nearly 30% year-on-year in January 2026, driven by strong growth across major commodity groups and key export markets, according to the Ministry of Agriculture and Environment. Export turnover for the sector in January is estimated at nearly US$6.51 billion, up 29.5% from the same period last year, the ministry said at a regular press briefing on February 5.

INFOGRAPHIC SOCIAL-ECONOMIC PERFORMANCE IN JANUARY OF 2026

The monthly statistical data presents current economic and social statistics on a variety of subjects illustrating crucial economic trends and developments, including production of agriculture, forestry and fishery, business registration situation, investment, government revenues and expenditures, trade, prices, transport and tourism and so on.

PHUC VUONG DISTRIBUTES "TET REUNION" GIFTS: SENDING LOVE TO THE CONSTRUCTION SITES

On the afternoon of February 6th, amid the busy year-end atmosphere, Phuc Vuong Company organized the "Tet Reunion – Spring Connection" gift-giving event right at the construction site. This annual activity aims to honor the "dream builders" who have dedicated themselves to the company's growth. The General Director was present to personally express his sincere gratitude and hand over meaningful Tet gifts to the workers.

INTERNATIONAL ARRIVALS TO VIETNAM REACH NEW MONTHLY HIGH

International arrivals to Vietnam hit a new monthly record in January 2026, rising 21.4% from the previous month and 18.5% year-on-year, according to the National Statistics Office. Air travel continued to dominate, accounting for nearly 80% of all arrivals. Arrivals by land nearly doubled compared with the same period last year, while sea arrivals rose by about 30%, though they remained a small share.

HCMC APPROVES 28 MORE LAND PLOTS FOR HOUSING DEVELOPMENTS

HCMC has approved 28 out of 30 proposed land plots for pilot housing developments, covering a combined area of more than 750,600 square meters, according to a newly adopted resolution. The approved sites are spread across multiple wards and communes, with a strong concentration in the city’s southern and eastern areas.

VIETNAM SEES STEADY FDI DISBURSEMENT BUT SLOWER EXPANSION IN JANUARY

Foreign direct investment (FDI) disbursement in Vietnam rose in January, while newly registered capital fell sharply, pointing to stable project implementation but slower investment expansion. Data from the Ministry of Finance showed that January FDI disbursement increased 11.26% year-on-year to US$1.68 billion, reflecting continued execution and expansion of existing foreign-invested projects.