Want to be in the loop?

subscribe to

our notification

Business News

VIỆT NAM REMAINS ATTRACTIVE TO FOREIGN INVESTORS DESPITE TARIFF HEADWINDS

As long as the tariffs imposed by the US are no more than 10 per cent higher than those applied to regional competitors, Việt Nam’s pre-existing advantages, including workforce quality, competitive costs, favourable demographics, and strategic location, will continue to drive investor interest, VinaCapital said.

A production line of camera modules and electronic components for export at MCNEX VINA Co., Ltd, a South Korean-invested company in Ninh Bình Province. — VNA/VNS Photo Vũ Sinh

HCM CITY — Việt Nam is expected to remain an attractive destination for global manufacturers and foreign direct investment (FDI), even as the US moves forward with new tariffs on Vietnamese imports.

As long as the tariffs imposed by the US are no more than 10 per cent higher than those applied to regional competitors, Việt Nam’s pre-existing advantages, including workforce quality, competitive costs, favourable demographics, and strategic location, will continue to drive investor interest, according to investment management firm VinaCapital.

Following a call with General Secretary Tô Lâm on the evening of Wednesday, July 2, President Donald Trump announced that the US had reached a tariff agreement with Việt Nam – the first of its kind with an ASEAN country. While many details are still pending, the Vietnamese Government stated the agreement creates “a framework for a fair and balanced reciprocal trade agreement.”

The announced 20 per cent average tariff on imports from Việt Nam is around the consensus expectation and marks a significant improvement over the 46 per cent “reciprocal tariff” initially proposed by Trump on April 2.

The Vietnamese stock market reacted mildly positively to the news as of mid-day July 3, though shares of industrial park developers and exporters saw declines. In contrast, shares of US-listed companies with significant sourcing from Việt Nam such as Nike and Under Armour rose on Wednesday.

Looking ahead, the final agreement is expected to include a tiered tariff schedule, with significantly lower rates for products that are fully manufactured in Việt Nam.

“Once the final agreement is announced, we will take a closer look at the potential impact those rates may have. In the meantime, we believe the 10 per cent tariffs on Việt Nam's exports to the US (plus exemptions on most electronics products) currently in place will likely remain in effect until a final agreement is signed,” VinaCapital said.

Another key element in Trump’s announcement is a proposed 40 per cent tariff on transshipments. A recent Harvard study estimates that transshipments may account for 2 to 17 per cent of Việt Nam’s exports, while earlier reports cited a figure of approximately 14 per cent.

VinaCapital noted that the Vietnamese Government had been actively cracking down on transhipment practices since the first Trump administration and was likely to intensify these efforts. However, the firm stressed that the lack of a clear definition of “transshipments” would mean the actual impact would depend heavily on how the term is defined in the final agreement.

Despite the positive signals, VinaCapital does not expect the announcement to significantly impact the economy in the short term for several reasons.

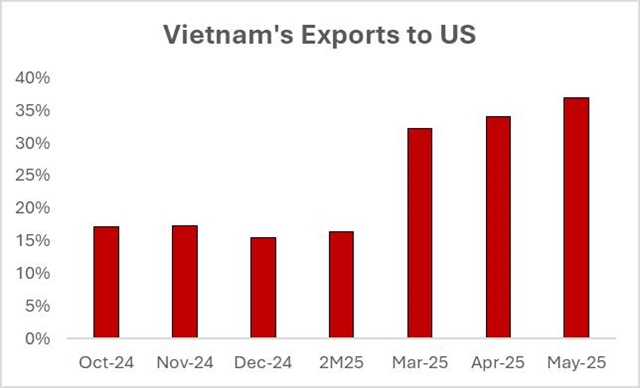

A chart shows an increase in Việt Nam’s export to the US this year. — Source: Customs, VinaCapital

First, exports to the US are expected to slow in the second half of 2025 after surging nearly 30 per cent earlier in the year. The surge was driven by US retailers rushing to secure goods during the 90-day temporary pause on reciprocal tariffs.

Meanwhile, FDI into Việt Nam remains strong. In the first five months of 2025, registered FDI rose nearly 50 per cent year-on-year to over US$15 billion or more than 7 per cent of GDP.

“Pending a final agreement, as long as Việt Nam’s tariffs are less than 10 per cent higher than regional competitors, all of the advantages it had pre-tariffs in terms of workforce quality, costs, demographics, and location continue to apply. Việt Nam should continue to be an attractive destination for global manufacturers and FDI for years to come,” the company said.

VinaCapital also reiterated that Việt Nam’s growth in 2025 would be driven primarily by internal factors, including increased public infrastructure investment, a revival of the real estate market, and significant government administrative reforms and initiatives, which some have called “Đổi Mới 2.0.”

In general, the company said “This initial announcement marks a constructive step forward for both countries. The 20 per cent tariff is far lower than the 46 per cent announced on April 2 and it removes some of the uncertainty that has loomed since then.

“In the meantime, the actions the Vietnamese Government has been taking and plans to take for the remainder of this year and beyond will be more important catalysts than exports for creating the growth required to meet its targets.” — VNS

Source: VNS

Related News

VIETNAM’S AGRO-FORESTRY-FISHERY EXPORTS JUMP NEARLY 30% IN JANUARY

Vietnam’s exports of agricultural, forestry and fishery products surged nearly 30% year-on-year in January 2026, driven by strong growth across major commodity groups and key export markets, according to the Ministry of Agriculture and Environment. Export turnover for the sector in January is estimated at nearly US$6.51 billion, up 29.5% from the same period last year, the ministry said at a regular press briefing on February 5.

INFOGRAPHIC SOCIAL-ECONOMIC PERFORMANCE IN JANUARY OF 2026

The monthly statistical data presents current economic and social statistics on a variety of subjects illustrating crucial economic trends and developments, including production of agriculture, forestry and fishery, business registration situation, investment, government revenues and expenditures, trade, prices, transport and tourism and so on.

PHUC VUONG DISTRIBUTES "TET REUNION" GIFTS: SENDING LOVE TO THE CONSTRUCTION SITES

On the afternoon of February 6th, amid the busy year-end atmosphere, Phuc Vuong Company organized the "Tet Reunion – Spring Connection" gift-giving event right at the construction site. This annual activity aims to honor the "dream builders" who have dedicated themselves to the company's growth. The General Director was present to personally express his sincere gratitude and hand over meaningful Tet gifts to the workers.

INTERNATIONAL ARRIVALS TO VIETNAM REACH NEW MONTHLY HIGH

International arrivals to Vietnam hit a new monthly record in January 2026, rising 21.4% from the previous month and 18.5% year-on-year, according to the National Statistics Office. Air travel continued to dominate, accounting for nearly 80% of all arrivals. Arrivals by land nearly doubled compared with the same period last year, while sea arrivals rose by about 30%, though they remained a small share.

HCMC APPROVES 28 MORE LAND PLOTS FOR HOUSING DEVELOPMENTS

HCMC has approved 28 out of 30 proposed land plots for pilot housing developments, covering a combined area of more than 750,600 square meters, according to a newly adopted resolution. The approved sites are spread across multiple wards and communes, with a strong concentration in the city’s southern and eastern areas.

VIETNAM SEES STEADY FDI DISBURSEMENT BUT SLOWER EXPANSION IN JANUARY

Foreign direct investment (FDI) disbursement in Vietnam rose in January, while newly registered capital fell sharply, pointing to stable project implementation but slower investment expansion. Data from the Ministry of Finance showed that January FDI disbursement increased 11.26% year-on-year to US$1.68 billion, reflecting continued execution and expansion of existing foreign-invested projects.