Want to be in the loop?

subscribe to

our notification

Business News

VIETNAM'S REMARKABLE REBOUND AMID GLOBAL UNCERTAINTIES

With its strong growth rates and expanding infrastructure, Vietnam has positioned itself as an attractive destination for European businesses looking to expand in the region.

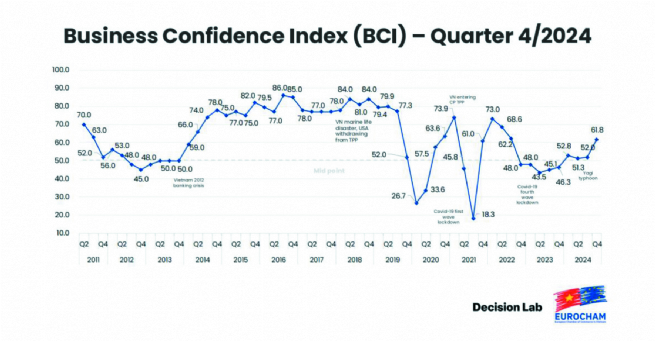

The latest Business Confidence Index (BCI) from EuroCham Vietnam, covering Q4 2024, reflects a notable rise in business sentiment, showcasing resilience amid global uncertainties. The BCI surged to 61.8, a significant leap from 46.3 in the previous year, indicating renewed optimism from European businesses operating in Vietnam.

The BCI score surged from 46.3 in Q4 2023 to 61.8 in Q4 2024, marking a pivotal shift from a neutral to a positive sentiment in both current and future outlooks. This surge comes despite ongoing operational hurdles and global economic uncertainties. Vietnam’s strong performance is, in part, attributed to the country’s continued growth trajectory, its improving infrastructure, and its emergence as a regional hub for both trade and investment.

For much of the past two years, the BCI hovered around the neutral midpoint of 50, dipping below it on occasions. The Q4 2024 report, however, marks a pivotal shift as the score reached its highest level since early 2022. According to the survey, 42% of respondents reported feeling positive about the current business situation, with 47% anticipating similarly optimistic conditions for the upcoming quarter. More prominently, 56% of respondents foresee improvements in Vietnam’s macroeconomic outlook in the first quarter of 2025.

“This is a clear sign that European businesses are increasingly confident about Vietnam’s economic future,” said Bruno Jaspaert, Chairman of EuroCham Vietnam. “This clear rise in sentiment reflects a broader recognition of the country’s ongoing political and economic transformation it has seen over the past years. The country’s GDP growth confirms its position as a central player in Southeast Asian regional trade and investment.”

Rising as a key investment destination

Perhaps most notably, 75% of survey respondents indicated they would recommend Vietnam as an investment destination. This data underscores the growing recognition of Vietnam’s strategic importance as an investment hub within Southeast Asia. With its strong growth rates and expanding infrastructure, Vietnam has positioned itself as an attractive destination for European businesses looking to expand in the region.

“The growing confidence in Vietnam as an investment destination is a testament to the country’s solid foundations in both trade and economic policy,” remarked EuroCham’s Chairman. “Despite the global challenges, Vietnam’s positive investment climate is creating new opportunities for European companies, especially in key sectors like technology, manufacturing, tourism and renewable energy.”

Thue Quist Thomasen, CEO of Decision Lab, echoed these sentiments: “A significant portion of businesses indicated plans to expand their operations in Vietnam. Approximately one out of four member companies are considering partnerships with Vietnamese suppliers or service providers, and more than one-fifth of the respondents are looking to expand their footprint in the country. Another 30% are looking to increase their import/export operations and/or shift production to Vietnam. This move aligns with Vietnam’s successful geopolitical positioning amid global trade shifts, particularly in light of recent disruptions to global supply chains.”

Vietnam’s status as an emerging leader in sustainable development and digital transformation further enhances its investment appeal. Many respondents highlighted the country’s dual transformation in green and digital sectors as pivotal. Businesses that embraced these transitions reported notable revenue growth, with some recording a 40% increase compared to the previous year.

Operational challenges remain, but restructuring efforts bring hope

While the overall sentiment is positive, operational challenges continue to be a significant concern for European businesses in Vietnam. As in previous surveys, the top three operational obstacles identified were administrative burdens, unclear regulations, and difficulties in obtaining licenses and permits. The complexities of visa requirements for foreign workers and experts topped the list of administrative challenges, with 42% of responses highlighting this as a primary concern. Tax-related issues, including VAT refunds, were also cited by 30% of respondents, with further challenges related to import/export and investment registration procedures.

“Vietnam is at a critical juncture,” noted Chairman Jaspaert. “These ongoing administrative hurdles challenge business operations, but we are optimistic about the government’s determination to create a more conducive environment. Initiatives such as the steering committee for government restructuring show promise. At EuroCham, we strive to contribute best practices and counsel to debottleneck the current issues. Our annual WhiteBook will focus specifically on these matters and offer implementations to overcome them.”

In November 2024, Prime Minister Pham Minh Chinh announced the formation of a steering committee to restructure Vietnam’s government system. The goal of this initiative is to improve efficiency, decentralize administrative functions, and strengthen local accountability.

Many respondents to the survey expressed optimism that these reforms would lead to significant improvements in administrative processes, with 43% expecting streamlined procedures in the long term, particularly with the adoption of digital platforms and reduced paperwork requirements. However, 36% of respondents also expressed concerns about potential delays in processing applications during the restructuring phase. Despite these challenges, the government’s commitment to digital transformation and e-governance was viewed as a positive step forward by a significant portion of the business community.

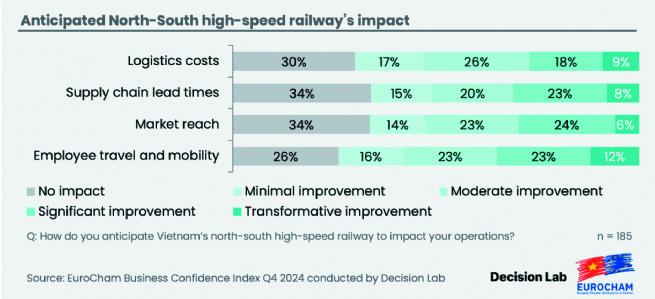

Infrastructure remains another key focus area, with projects such as the North-South high-speed railway and Long Thanh International Airport expected to bolster Vietnam’s logistical capabilities. These developments are set to reduce costs, improve supply chain efficiency, and enhance overall business competitiveness.

Vietnam’s resilience following Typhoon Yagi further exemplifies its capacity to navigate adversity. Despite significant disruption, European businesses reported a swift recovery, with many implementing new risk management strategies to mitigate future disasters.

Looking ahead, Vietnam’s economic prospects remain bright. With continued reforms, expanding infrastructure, and an ever-growing focus on sustainability, the nation is poised to solidify its status as a leading investment destination in Southeast Asia. European businesses are set to play a vital role in this journey, driving innovation, and contributing to Vietnam’s long-term prosperity.

Source: VCCI

Related News

VIETNAM’S SEAFOOD EXPORTS HIT OVER US$10 BILLION IN JAN-NOV

Seafood export revenue in November alone amounted to nearly US$990 million, up 6.6% year-on-year. Key product groups posted solid gains. Shrimp exports rose 11.7% to over US$385 million, supported by strong demand for whiteleg shrimp and lobster. Tra fish shipments increased 9.7% to almost US$197 million, while marine fish, squid, and mollusk exports maintained their recovery.

VIETNAM’S AGRO-FORESTRY-FISHERY EXPORTS HIT NEW RECORD IN JAN-NOV

Vietnam’s agro-forestry-fishery export revenue reached an estimated US$64.01 billion in the first 11 months of 2025, up 12.6% year-on-year and surpassing the full-year record of US$62.4 billion set in 2024. Agricultural exports reached US$34.24 billion, up 15% year-on-year, while livestock products brought in US$567.4 million, a 16.8% increase. Seafood exports rose 13.2% to US$10.38 billion, and forestry products earned US$16.61 billion, up 5.9%.

HANOI REPORTS RECORD-HIGH BUDGET REVENUE IN 2025

Hanoi’s budget revenue is estimated to reach VND641.7 trillion in 2025, the highest level ever recorded and nearly 25% above the revised target, according to a report by the municipal government. Data from the city’s socioeconomic performance review shows that total state budget collections in 2025 are projected to reach 124.9% of the adjusted plan and rise 24.9% from 2024, the Vietnam News Agency reported.

VIETNAM, CHINA TO PILOT TWO-WAY CARGO TRANSPORT AT LANG SON BORDER

Vietnam and China will launch a one-year pilot program on December 10 to allow two-way cargo transport through the Huu Nghi–Youyi Guan international border gates in Lang Son Province, reported the Vietnam News Agency. The Dong Dang-Lang Son Economic Zone Management Board said the trial aims to reduce transport costs and improve customs clearance capacity.

VIETNAM’S IMPORT-EXPORT VALUE NEARS US$840 BILLION IN JAN-NOV

The total value of Vietnam’s imports and exports was nearly US$840 billion between January and November this year, the highest level ever recorded, according to the National Statistics Office. In its latest report on the country’s socio-economic performance, the National Statistics Office highlighted a series of positive economic indicators, with trade emerging as one of the strongest drivers of growth.

OVER 19 MILLION INTERNATIONAL VISITORS COME TO VIETNAM IN JAN-NOV

Vietnam received more than 19.1 million international visitors in the first 11 months of 2025, a 20.9% increase year-on-year and the highest level ever recorded, according to the National Statistics Office. The figure surpasses the full-year record of 18 million arrivals set in 2019, before the Covid-19 pandemic. Nearly two million foreign visitors arrived in November alone, up 14.2% from October and 15.6% from the same period last year.