Want to be in the loop?

subscribe to

our notification

Business News

INFRASTRUCTURE INVESTMENT SPURS LONG-TERM UPSWING FOR VIETNAMESE STOCKS

The public investment sector is still viewed as having strong long-term potential, underpinned by the ongoing acceleration in capital disbursement and expectations of sustainable growth.

A construction site for the connector road project linking the North-South Highway to National Route 1A and the Cà Ná General Port in Khánh Hòa Province. — VNA/VNS Photo

HÀ NỘI — Việt Nam’s accelerating public investment is providing a critical boost to the economy and paving the way for sustained stock market gains, especially in the infrastructure, construction, materials and logistics segments.

According to the Ministry of Finance, public investment disbursement reached VNĐ268.1 trillion (US$10.3 billion) by June 30, representing 32.5 per cent of the approved 2025 budget, well ahead of the 28.2 per cent rate reported in the same period last year.

With full-year disbursement targeted at VNĐ825.9 trillion, 21 per cent more than the 2024 allocation and 29.9 per cent higher than last year's disbursement, analysts say funding flows are creating growth potential across multiple sectors.

In a July 7 report, VinaCapital described public investment as "the backbone" of Việt Nam’s growth outlook in 2025. The firm has increased its holdings in construction materials, infrastructure and logistics since the first quarter (Q1) in anticipation of capital inflows tied to Government spending.

Earnings momentum is already visible among listed firms. Infrastructure heavyweights like Vinaconex (VCG), Fecon (FCN), Coteccons (CTD) and Licogi 16 (LCG) have surged, reflecting their strong track records in large-scale projects, solid governance and capable capital management.

Sector players are also seeing tangible benefits. Elcom, a provider of intelligent transport systems and ICT infrastructure, reported rising half-year revenue bolstered by over VNĐ1 trillion in recently secured contracts.

A representative from Elcom stated that several of the company’s major technology infrastructure projects are currently being fast-tracked. This is a pivotal phase for revenue recognition and for laying the groundwork for sustained growth.

Backed by its proprietary 'Made by Elcom' technology platform and decades of experience executing large-scale projects across Việt Nam, the company is optimistic about integrating 'Make in Vietnam' solutions, designed and produced domestically, into public investment initiatives.

The company believes this approach will deliver high utility value, helping it exceed its 2025 business goals and drive strong growth in the years ahead.

Deo Ca Traffic Infrastructure Investment (HHV) continues to enjoy steady cash flows from build-operate-transfer road projects, with additional growth anticipated from the North - South high-speed rail partnership.

The Quảng Ngãi - Hoài Nhơn and Đồng Đăng - Trà Lĩnh expressway projects are expected to be key revenue contributors for Deo Ca Traffic Infrastructure Investment JSC over the next two years, as both are scheduled for completion in 2025 and 2026, respectively.

The company is currently proposing to undertake an expansion of the North–South Expressway, aiming to widen 1,144 kilometres of roadway from four lanes to six. The proposed total investment exceeds VNĐ152 trillion. With the Government’s contractor designation mechanism favouring companies with prior involvement, such as in the Cam Lâm - Vĩnh Hảo and Bắc Giang - Lạng Sơn sections of the same corridor, Deo Ca stands a strong chance of being awarded the contract.

If secured, this would significantly boost the company's construction backlog for the 2026–30 period and generate substantial cash flow.

The Government has set targets of developing 3,000km of expressways by 2025 and 5,000km by 2030. To meet these goals, many expressway projects in the 2026–30 phase will be accelerated, offering the company expanded opportunities to participate in new developments.

It also stands to benefit from future railway infrastructure projects. According to national plans, railway development initiatives through 2050 will create a substantial long-term project pipeline for Deo Ca, positioning it to leverage its expertise as one of Việt Nam’s leading transport infrastructure contractors.

Workers at a construction site in Khánh Hòa Province. — VNA/VNS Photo

Meanwhile, Vinaconex's earnings is projected to grow, supported by a substantial backlog of approximately VNĐ16 trillion.

This backlog is projected to secure revenue for 2025, while the potential to secure new contracts could ensure continued growth in subsequent years.

Additionally, the company is also launching multiple new property projects, positioning its real estate segment as a new growth driver. Meanwhile, its financial investment activities continue to generate stable cash flows.

On the market, public investment-related stocks have shown notable performances. HHV shares are up nearly 2.5 per cent month-on-month and more than 6.8 per cent year-on-year. ELCOM (ELC) rose more than 2 per cent over the past week, and Vinaconex (VCG) gained 14 per cent in the past month and 42 per cent over the past year.

Senior Director at KIS Vietnam Securities Trương Hiền Phương said that companies in the public investment group are benefiting from the Government’s aggressive push to disburse capital for public projects. Business operations across the group are expected to improve and potentially accelerate.

However, stocks in this segment have yet to fully attract investor attention, he said.

Phương cited a few key reasons for this, particularly the fact that overall market conditions have influenced capital flows.

Meanwhile, the sector’s individual appeal remains limited when compared to others such as banking, real estate, securities or steel — sectors that offer more distinct investment narratives.

Phương added that while these companies may benefit from public investment, their other business segments may not be performing as positively.

Looking ahead, the public investment sector is still viewed as having strong long-term potential, underpinned by the ongoing acceleration in capital disbursement and expectations of sustainable growth. — BIZHUB/VNS

Source: VNS

Related News

PRACTICAL CONSTRUCTION WORK

At Phuc Vuong, we do not focus on talking about our capabilities. Instead, every project currently under construction serves as the clearest and most direct proof. From site preparation, piling works, and foundation construction to structural works and major items, our technical team remains closely involved on site, monitoring every detail.

INTERNATIONAL ARRIVALS TO PHU QUOC AT RECORD HIGH

On January 17, Phu Quoc International Airport handled 47 international flights in a single day, the highest level since the airport began operations. Earlier, on January 3, the airport had already set a new record with 46 international flights in one day. Notably, the surge was not confined to a few peak days. International arrivals were maintained at a high level throughout January, pointing to a more sustained and stable expansion of the international travel market to the island.

VIETNAM PUTS SCIENCE, TECHNOLOGY AT CENTER OF 2026 GROWTH STRATEGY

Vietnam will make science and technology, innovation and digital transformation the core drivers of economic growth in 2026, under a Government resolution guiding this year’s socio-economic development and budget implementation. The direction is set out in Resolution No. 01 on key tasks and solutions for 2026, reported the Government news website (baochinhphu.vn).

VIETNAM ECONOMIC NEWS INSIGHT & RECAP - DECEMBER 2025

Vietnam closed 2025 with an impressive economic performance, exceeding initial targets and demonstrating the resilience of its growth model. Full-year GDP expanded by 8.02% supported by a combination of government-led stimulus, stable domestic production and consumption, and continued strength in key export sectors amid ongoing external uncertainties.

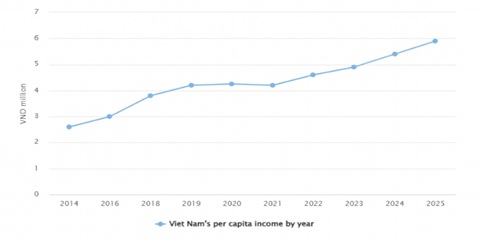

PER CAPITA INCOME CLIMBS 9.3% IN 2025

Average per capita income in 2025 was estimated at VND5.9 million (approximately US$225) per month, marking a 9.3 percent increase from 2024, according to preliminary findings of the Household Living Standards Survey 2025 conducted by the National Statistics Office (NSO). Part of the income growth stemmed from State payments to public officials and employees who retired or resigned under the restructuring of the political system's organizational apparatus.

INDUSTRY AND TRADE SECTOR MAINTAINING GROWTH MOMENTUM, FORGING SUSTAINABLE DEVELOPMENT

In 2025, Hai Phong City benefited from significant opportunities created by an expanded development space following administrative consolidation, while also facing challenges in maintaining stable and efficient administrative operations and sustaining strong economic growth amid ongoing global volatility. Within this context, the industry and trade sector continued to serve as an important driving force for the city’s overall economic growth.